Russia’s economy is showing signs of strain amid high inflation and a tightening labour market, which G7 and European officials say is proof that western sanctions over the war in Ukraine are working.

The Central Bank of Russia, which is independent from the government, delivered a new warning on Friday. The bank’s governor Elvira Nabiullina said the economy remained “substantially overheated,” after members raised its key interest rate to 18 per cent — the highest level in over two years — and said annual inflation has risen to nine per cent.

“For inflation to begin decreasing again, monetary policy needs to be tightened further,” the bank said in a statement, hinting at even more rate hikes.

The rate decision came days after eight European finance ministers wrote in The Guardian this week that Russia was experiencing what they called a “re-Sovietization of the economy.” They said reports of GDP growth, which the Kremlin has touted as proof the economy is thriving, only tell one side of the story.

“When taking a closer look at the signals, it becomes clear that everything is not as rosy with the Russian economy as Moscow would have us believe,” the article attributed to the finance ministers from Sweden, Denmark, Estonia, Finland, Latvia, Lithuania, Netherlands and Poland says.

The ministers said Russia has had to tap into its liquid national wealth fund assets, valued at US$55 billion as of April 1 by Russia’s finance ministry, to fund its war industry, which has become central to the national economy. But finance ministry data shows that value has plunged by nearly 50 per cent, from US$104.7 billion before the war, Bloomberg reported.

Finland’s central bank reported in May that Russia’s spending and output in the military industrial sector has sharply outpaced other industries since 2022, “increasing economic imbalances and eroding Russia’s longer term growth potential.”

Meanwhile, Moscow has introduced export bans on petroleum and sugar, as well as strict capital controls, to ensure domestic supply and the retention of private funds.

Get daily National news

Get the day’s top news, political, economic, and current affairs headlines, delivered to your inbox once a day.

All of these are hallmarks of the Soviet economy, the ministers write.

“History clearly shows that this is not a successful long-term strategy,” the article says.

“The short-term overheating of the economy, fuelled by heavy investments in the war industry and very limited access to technology, will likely hinder productivity gains and result in stagnation of the private sector, even more rampant inflation and increasing pressure on Russian households.”

The ministers say this is proof that sanctions — which have targeted Russian assets abroad and its ability to import and export goods and materials, including energy products and military components — are working and must be strengthened and expanded.

A Canadian finance ministry official, speaking to Global News on background, pointed to other indications that “Russia’s economy is in trouble,” including rising inflation, which Russia’s central bank said Friday was up from 8.6 per cent in June and 7.4 per cent in 2023.

Canada believes sanctions are effective and will “do whatever it takes” to pressure Russia to end its invasion and “ensure Ukraine is victorious,” a spokesperson for Finance Minister Chrystia Freeland’s office said.

“Those sanctions have financially cut Russia off from much of the global economy and are having a real and sustained impact on the Russian economy,” Katherine Cuplinskas told Global News in an email.

Canada has sanctioned more than 3,000 entities and individuals in Russia, Ukraine, Belarus and Moldova over their support of Russia’s invasion, a spokesperson for Global Affairs Canada said.

“Canada will continue to apply economic measures in coordination with its partners, including the G7,” Charlotte MacLeod said in a statement.

The United States, United Kingdom and European Union have also targeted Chinese, Iranian and North Korean entities to crack down on alleged sanctions evasion and material support for the war.

U.S. Treasury Secretary Janet Yellen on Thursday said the threat of U.S. sanctions on Russia’s financial institutions is impairing its ability to acquire the goods needed for its war against Ukraine.

Yellen also said she believes Russian revenues have been constrained by other sanctions and a price cap on Russian oil exports.

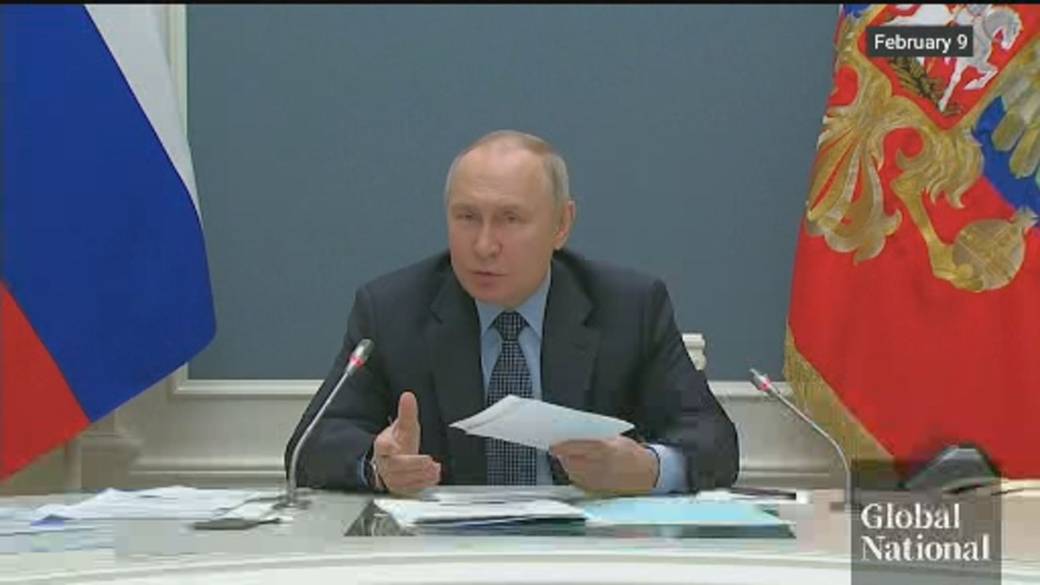

The G7 last month approved a plan that will use future revenue from frozen Russian assets in their countries to back a US$50-billion loan to Ukraine. Canada will contribute $5 billion to the plan, which Russian President Vladimir Putin decried as “theft.”

The International Monetary Fund this month predicted Russia’s GDP will grow by 3.2 per cent this year, but will fall to 1.5 per cent in 2025.

Russia has managed to keep its economy afloat through strengthened trade, energy and security partnerships with countries like China, India, Brazil and Vietnam, despite pressure on those countries from Ukraine and its western allies to cut ties with Moscow.

But western officials and experts say the continued focus of spending on Russia’s war machine is leaving other sectors vulnerable.

Apart from inflation, Russia has entered a wage growth spiral fuelled by generous payments for volunteers to fight in Ukraine and defence sector workers. It is also suffering from acute labour shortages in many sectors.

The workforce has resorted to using teenagers, older people and even prisoners to fill those gaps, with reports that some are being told their labour will allow them to avoid mobilization or jail time.

More than a million people are estimated to have left Russia since the war in Ukraine began, either due to the partial mobilization of troops ordered in September 2022 or young men fleeing the country to avoid enlistment.

The central bank’s policy has helped Russia cope with the impact of sanctions, but critics argue that the regulator is stifling economic growth, which has just recovered to a rate of five per cent.

Russian lawmakers on Thursday gave preliminary approval to proposed legislation that would allow foreign banks to open branches in Russia, a step the finance ministry said it hoped would alleviate issues with cross-border settlements.

International settlements have been a problem for Moscow after sanctions blocked major Russian banks’ access to the SWIFT global payments system.

“Settlements are the economy’s connecting thread,” Deputy Finance Minister Alexei Sazanov told lawmakers when presenting the bill, which was passed during its first reading in the State Duma, the lower house of parliament.

“Without settlements, the functioning of the economy is not possible.”

— with files from Reuters